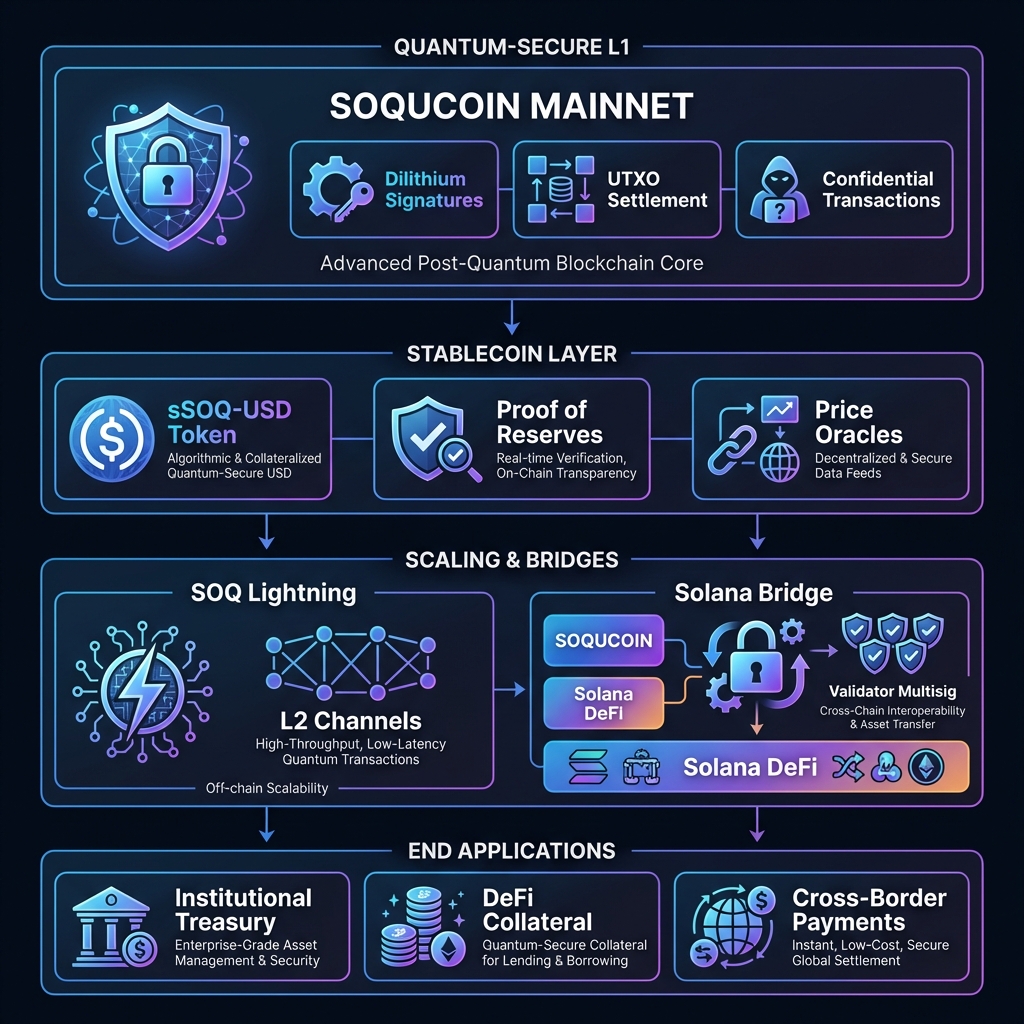

SOQ Lightning

STAGE 5 • 2027A Layer 2 payment channel network built on Soqucoin's quantum-resistant foundation. Instant, low-cost transactions with the security guarantees of post-quantum cryptography. Unlike Bitcoin Lightning, SOQ Lightning uses post-quantum adaptor signatures ensuring long-term security even as quantum computing advances.

📊 Market Opportunity

$150T+ — Global payments market (2025)

$600B+ — Annual remittance flows

$500B+ — Cross-border B2B payments

$340B — Gaming industry (micropayments)

6.5% — Avg remittance fee (target: <1%)

3-5 days — Traditional settlement (target: <1s)

Sources: World Bank Remittance Prices, BIS, Statista, McKinsey Global Payments Report 2025

Post-Quantum HTLCs

Hash Time-Locked Contracts secured by Dilithium signatures. No ECDSA attack surface.

Instant Payments

Sub-second payment finality for retail, micropayments, and streaming transactions.

Cross-Chain Swaps

Atomic swaps with other Lightning networks via quantum-resistant bridge contracts.

Merchant Integration

Point-of-sale compatible with instant settlement to L1 or channel balance.

Target Use Cases

Retail Payments

Coffee shops, restaurants, and retailers accepting instant SOQ payments.

Gaming & Micropayments

In-game purchases, streaming tips, and pay-per-use services at fractions of a cent.

Remittances

Cross-border payments settling in seconds instead of days, with minimal fees.